Overview

The Bennett Institute / Janeway Institute Digital Economics & Policy Initiative will be hosting several joint endeavours drawing on different sources of expertise and experiences in order to shape more effective policies.

Our focus is on data-enabled transformation of firms, market structure, and forms of organization. We will approach this by looking into particular industries.

Topic 1

Applied Digital Economics & Policy Workshop: Construction and Infrastructure

July 2021

Our first workshop covered the policy implications of digital economics in construction and infrastructure markets. The starting hypothesis was that the introduction of digital tools at different stages of the supply chain (design-feasibility-construction-operation) has the potential to (a) change the structure of value creation and capture, and hence market structure, and (b) enhance productivity along with other measured and non-measured outcomes (quality, reduced waste, energy efficiency, safety, speed….). Digitalisation started slowly in the sector but seems to be progressing rapidly now:

- Computer aided design has been standard for years but is being replaced by more comprehensive Building Information Modelling or Management (BIM);

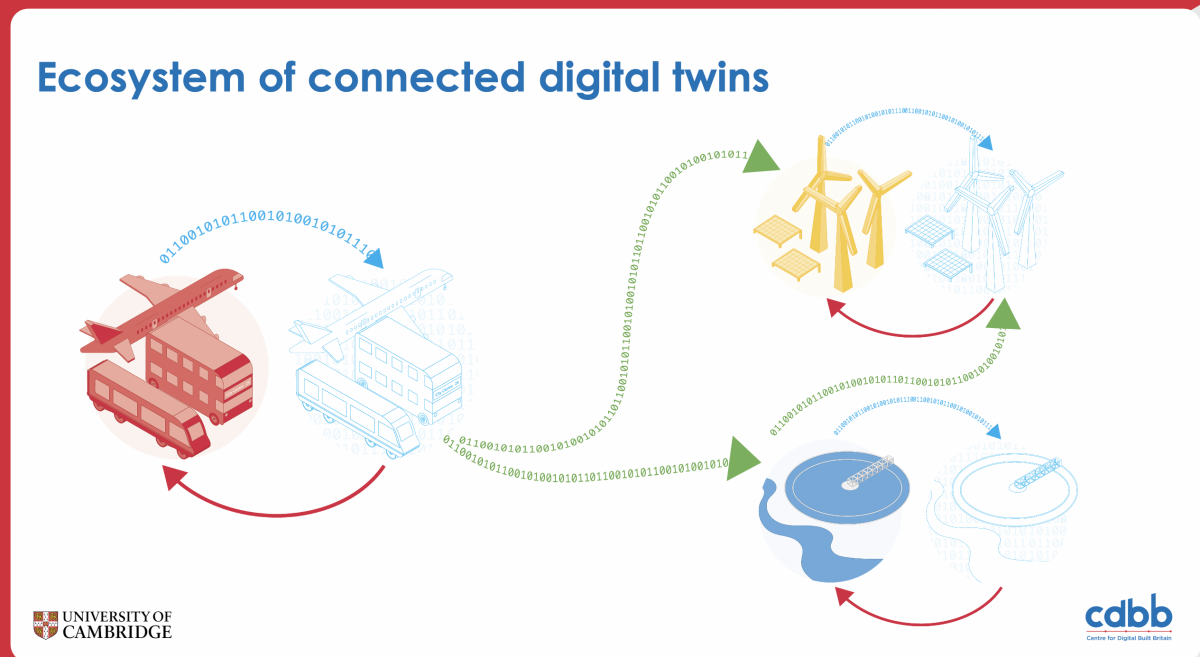

- 'Digital twins' are becoming widely used;

- 5G is expected to greatly increase data use during and after construction phase;

- There is a progressive shift from making everything on-site to more automated off-site construction of components giving rise to advanced manufacturing technologies and the potentially manufacturing-led supply chains;

- Practitioners and academics are increasingly exploring use cases for blockchain, distributed ledger technology and smart contracting in construction; and

- Buildings and structures are now becoming sources of data during their operational phase.

All these developments notwithstanding, construction has had scant measured labour productivity growth since the 1990s (though there are differences between sub-sectors). In the national accounts, it is defined as a distinct sector from architecture/design & engineering consultancy upstream, and maintenance & operation downstream. Plus, despite accounting for 7% of (UK) GDP and so being an important sector, and the seeming proliferation of construction economics masters and textbooks, it has not been a focus of research in economics departments nor in digital and economic policy debates.

The aim of this workshop was therefore to understand the current and potential future developments in the construction sector in relation to the past and to explore what digitalisation means for how value is created, captured and measured in the sector.

Workshop Findings

Several themes were identified as key issues in the intersection between construction & digital economics:

Industry Characteristics

• The industry today is characterized by a complex system of subcontracting. Consulting firms mainly manage a contract by hiring out most functions of the construction to subcontractors, and companies have seen a shift from technical capability to commercial management to manage those subcontracts.

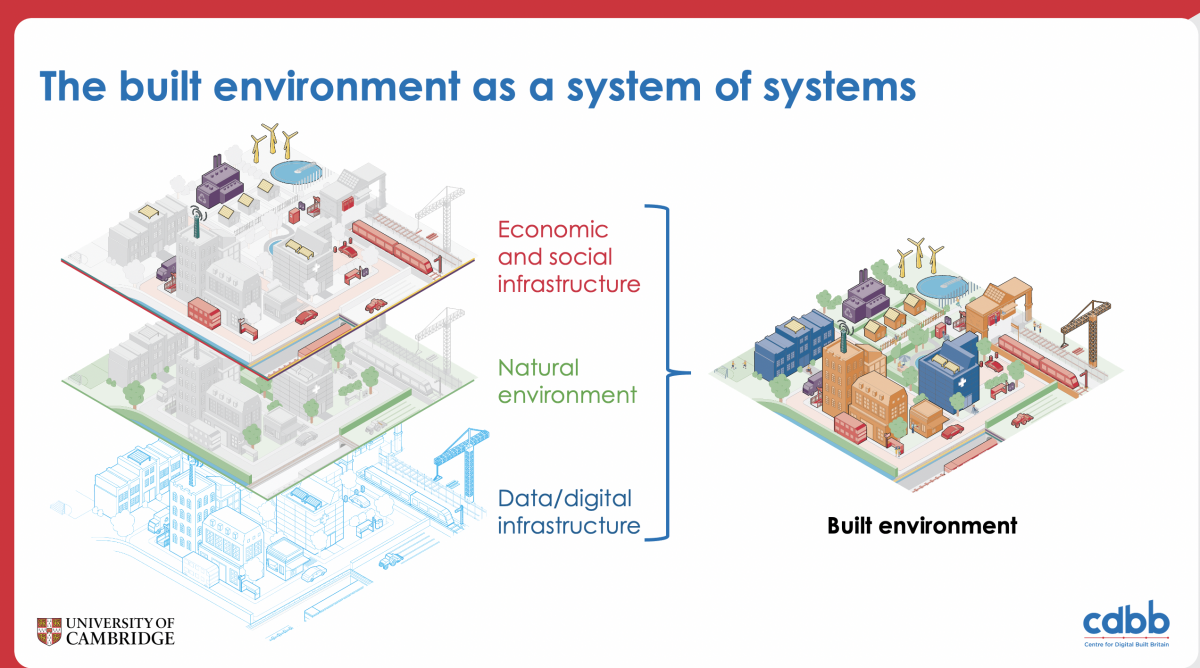

Source: CDBB

Productivity

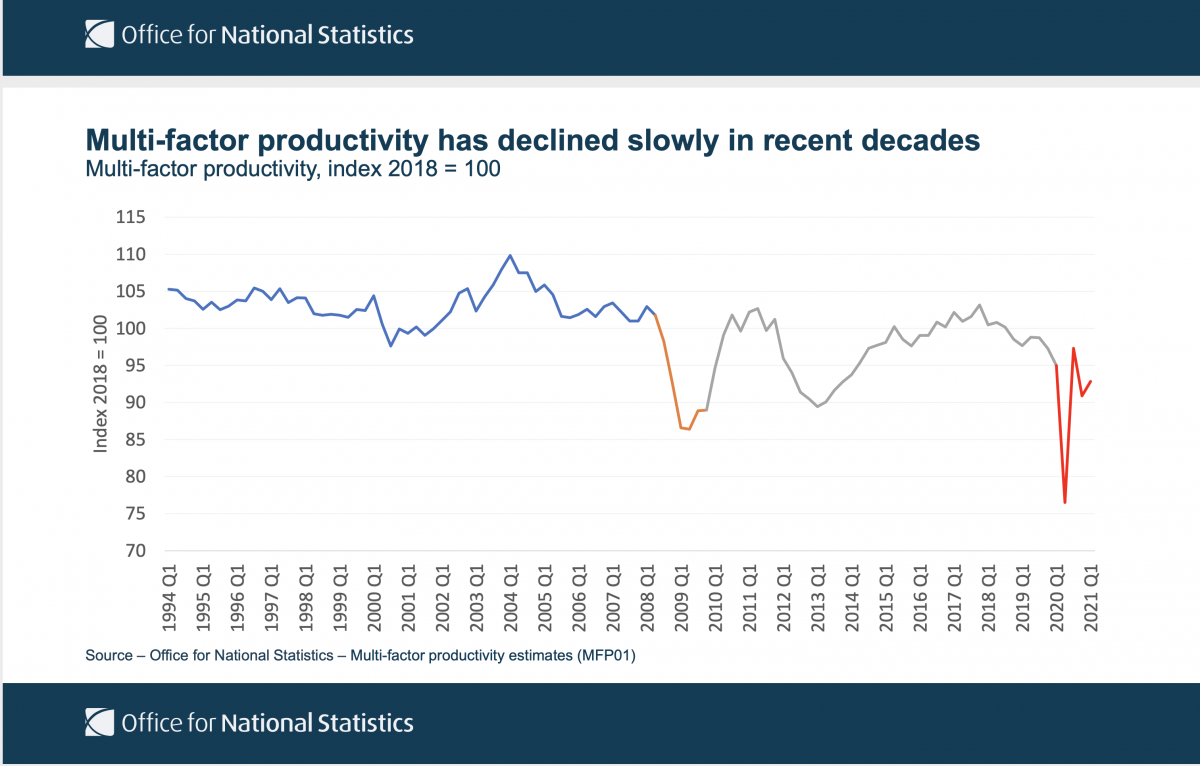

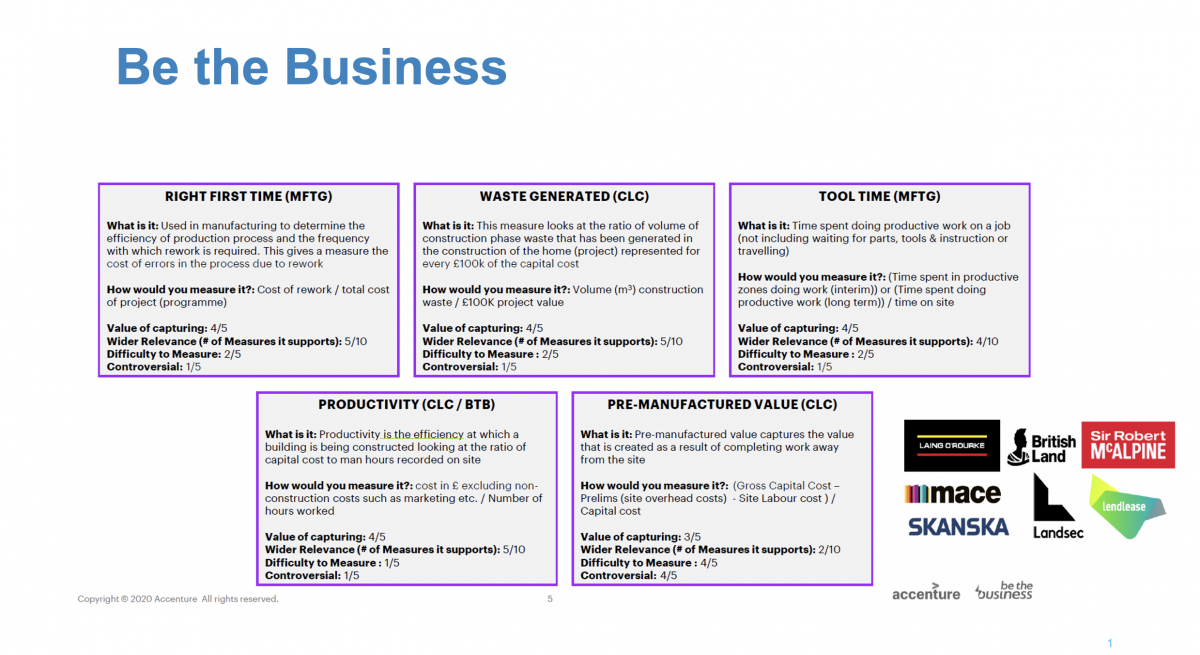

• Construction, accounting for 6-7% of GDP, unlike many other industries, has not seen a great increase in productivity in the past 20 years. Instead, ONS reports declining multi-factor productivity in recent decades. Possible reasons for this include the methodology of measuring productivity, the fragmentation of the construction process, and the focus on price competition in the sector. As relates to measurement, one issue is that the efficiency of a construction project often depends on the efficacy of the teams that manage the project on the site. Multiple industry related initiatives are interested in measuring productivity. Streamlining the industry would help address this by providing a clear understanding of the structure of an industry, and of the metrics in use or to be used.

Source: ONS

Streamlining

• The industry could benefit from a more holistic approach. It would be helpful for policymakers and stakeholders to think of construction projects as being interventions on the overall interconnected system of systems that makes up the built environment. This would signify identifying first if the required outcome could be obtained by optimising what already exists, and therefore building nothing, or ensuring that, where the required intervention does include new assets, they are integrated effectively with the existing system. This would signify a move away from focusing purely on project cost-saving and moving towards recognising the value of achieving outcomes for the benefit of the people who will use the asset.. Crucially, technology is only one part of digital transformation, which is an enabler and will not solve the problems alone. It is important to understand digital transformation as a socio-technical process with people, not technology, at the centre. When conceptualised in this manner, the benefits of streamlining include enabling people to use information better, to make better decisions, to make processes more efficient, and to apply technology more wisely.

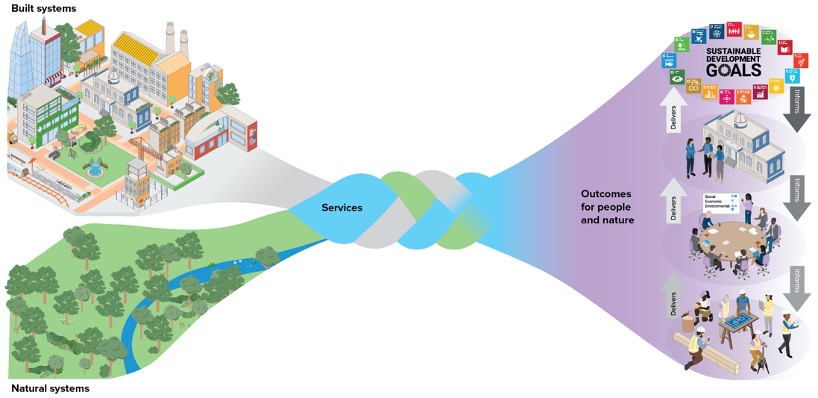

Source: www.visionforbuiltenvironment.com

Risk Aversion

• Intense price competition leads to lower profit margins, which may increase risk aversion among stakeholders. Firms might be slower to innovate since they could have to make significant capital expenditure investments while competing on price. A move toward greater emphasis on quality, longevity, and environmental impact would be welcome. Currently, clients attempt to transfer risk down the supply chain without consideration of who is best placed to mitigate it. Cost gets multiplied as they progress down the supply chain as organisations try to cover themselves for the risk they are being asked to take responsibility for. Risk should be jointly owned with the Client where possible and allocated based on capability.

Fragmentation

• The industry should develop an understanding of the extent to which fragmentation is a binding constraint to productivity growth, particularly in the context of an outcomes- oriented approach. This will help to contextualise both concerns and potential opportunities and to avoid misdiagnosing the problem.

Procurement Practices

• There is significant potential to innovate when it comes to public procurement policies in the construction industry. The current procurement system is a barrier to innovation. The industry needs a grander coalition of vision to disrupt the current processes and systems in a way that allows not only the lowest cost solutions to predominate. Public policy could take the lead by addressing the need for outcome-oriented investments that recognise long-term innovations such as more durable or low-carbon construction, and the importance of cultural alignment, capability and quality, none of which may be reflected in lowest-price competition.

Net Zero

• The industry should develop a better understanding of what impact its projects have on human environments, nature, and targets such as Net Zero. At present, the construction industry still struggles to adjust to its impact on environment. In thinking about creating a more sustainable economy globally, the construction industry has started to redefine what is meant by value to account for human capital, produced capital, natural capital. There is an opportunity to consolidate this development with better measurement and monitoring mechanisms. Currently the industry does not measure the performance of infrastructure or ask the users if it is providing the service that they require. A project could be delivered very productively but not achieve the desired outcome. There are initiatives in the industry and Government to look at system level infrastructure performance metrics, rather than just the productivity of adding new assets.

Source: accenture

Digital Twins and the Information Value Chain

• Digital assets are not currently valued properly; data, algorithms, and digital twins should be given greater importance in the industry. Digital twins—digital counterparts of a physical object or process—could be helpful in understanding the value of data. Developing the capacity to communicate this value in the language of the capital markets could be a critical transformation enabler.

Source: CDBB

A System of Systems

• Concentrating solely on construction as a standalone industry would miss the wider interconnected processes. This would be a significant omission because although construction contributes a significant of GDP, approximately 99.5% of the built environment needed has already been constructed and only 0.5% is added to it every year. Ultimately, if we accept that it is the system that delivers the outcomes for people, more needs to be done to understand the value of achieving desirable outcomes by taking into consideration both built and natural systems. As we move towards a circular economy, new business and economic models may be required.

Suggested Research

Areas for suggested academic research include:

• Understanding the economics of construction at the project or company level, including the role of new entrants in innovating;

• Understanding the relationship between the industry structure and the regulatory environment;

• Developing a shared understanding of the boundaries of the construction industry, including the value chain and the companies included in the value chain;

• Identifying offsite manufacturing companies and establishing how they are classified in official statistics;

• Understanding what productivity means and how it should be measured in the construction context;

• Establishing how to account better for input and output measurements, including experience and on-the-job training as relates to work and skillsets;

• Identifying which factors in the classification of construction companies are responsible for showing declining productivity;

• Looking at the total lifecycle cost of the built asset and how this might result in a better pricing model;

• Exploring further how digital twins can aid the construction industry, including the creation of language and standards that allows investors to capture the value of intangibles;

• Investigating how to solve the transaction costs problem in the construction industry;

• Understanding how project owners might have a stronger role to play as the ultimate aggregators of data;

• Understanding the value of data and developing mutually open data standards to enable value creation;

• Identifying the similarities between construction and other sectors, and between different project types;

• Developing robust mechanisms for measuring, monitoring, and analysing the value implications that construction has on human capital, produced capital and natural capital;

• Developing system level infrastructure performance metrics, and ways of capturing feedback on the use of infrastructure, rather than just measuring the productivity of adding new assets;

• Exploring the drivers for financial market involvement in the industry, including the increasing presence of Private Equity; and

• Exploring how to reform the procurement process.

Further Information on Topic 1

Background on Industrial Transformation:

Other useful Links:

Centre for Digital Built Britain

UK Government Construction 2025 Strategy

UK Government Construction Playbook